8 tips to stay on top of your freelance finances

Author:

Rosa Koolhoven

Date:

April 21, 2024

Published on:

vanschneider.com

Like it or not, being a freelancer also means being a business owner. And this involves the boring subject of finances.

This article was first published on D E S K - the well known design blog of the awesome Tobias van Schneider.

It’s not always easy as a creative person to also have that savvy business mindset and wrap your head around taxes, expenses and budgeting. The good news: Being proactive about it means you don't have to worry or think about it as much. Here are some strategies and ways of thinking that I've developed these past few years to stay on top of my finances and keep everything organized.

Tip 1 Open multiple bank accounts

In most countries, it doesn’t cost much (if anything at all) to open multiple bank accounts. At this moment I have 7 bank accounts divided over two different banks. One bank for my personal and one for my business expenses.

Multiple bank accounts essentially help you keep you organized. You could theoretically do everything with just one account, but because our brains are often messy, multiple bank accounts help us to keep mental tabs on what’s happening.

Since I started freelancing I’ve always had at least three business accounts, below are some examples to get you started. You can always do it with less accounts of course, but I like to keep things organized.

Examples of the accounts I have are:

Business account

This account is your main account for incoming money as well as any business-related expenses. Unless you move money into savings, this is the account that would hold the majority of cash.

Personal account

This account is for anything that is not a business expense and therefore not a tax-deductible, such as apartment rent, utilities, clothing or other personal purchases.

Times-12 account / Bills Account

Explained in detail below (see Tip Nr.7)

Income Tax & Sales Tax Saving Accounts

This account only exists to keep my tax money before I have to pay it. So for example, if someone pays me $1,000, I move $500 (50%) immediately to this account. Of course, the actual percentage depends on what country you live in. In your case, it might be less depending on your tax bracket.

Savings Account

Here you move all the money you’re not planning to touch for a while. Ideally an account with a higher interest rate for short term savings.

Pension Account

This account is usually a private pension fund and with another company then your personal bank.

Tip 2 "Not my money" mindset

With this, I’m talking about the tax money that you owe to the government. It’s plain simple... it’s not your money. Don’t spend it, don’t borrow from it and try to visually separate it from *your* money. Just leave it alone. I know this sounds very strict, but my greatest fear is to get a tax bill and not have the money together to pay for it. Besides the stress, if you pay late, you end up paying interest and penalties and it will only cost you more. And on the other side, if you put the money aside on a separate savings account, it can make (even if it’s maybe little) some interest for you.

The “not my money” mindset can easily be achieved by following the advice of opening multiple bank accounts and keeping the chunks of money clean and separated from each other.

Tip 3 Check every day and before you pay

I know exactly how much money there is on each of my accounts. People who say they never know how much money they have on their account, just blow my mind. Especially as a freelancer it is very important to stay on top of it. Luckily nowadays, most banks have amazing banking apps and they show you a quick overview of all your accounts together.

Before I buy something I always quickly check the status of my bank account, not to see if I have enough money to pay for it, but just so it becomes a real transaction. With all the contactless payments its very easy to spend money, without realizing how much you actually spend.

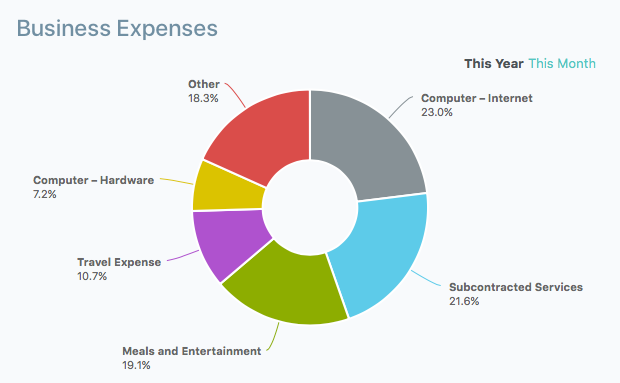

Make it a once a week, or even a daily ritual to log into your bank account or your accounting software (such as Quickbooks, WaveApps, Moneybird for example) and organize your transactions. The more often you do it, the less work it will be and you will have a pretty good overview of your profit & loss numbers.

PRO TIP: Put a recurring event in your calendar to remind you every other day.

Tip 4 My "Broke Budget"

I like to keep my running expenses account on a tight budget, I call it my Broke Budget. Seeing a low amount on my account helps me not overspend. Even though I have money on the other accounts, I like to think before I spend. You will prioritize better and you feel hesitant to spend it on something not worthwhile. I will move over money from my Short Term savings account when I do feel like spending it on something (plants, always more plants) but it helps to put another action in between, before I can buy it.

This can easily be achieved by having another separate savings or checking account that you always keep around a certain amount of dollars. Let’s say, for example, $1000 per month. If you spend more than that, you have to manually transfer more money from your other account. And it’s not so much about that this isn’t possible, it’s more about putting a little barrier in place to keep you away from overspending.

Tip 5 Don’t buy before payday

When there is something bigger I want to purchase for myself, like a nice new laptop backpack, I let myself wait until that one invoice is paid – even though I have money to spend or money coming in. I designate that one invoice to that specific purchase. This prevents me from impulse buys and I can budget it in. Sometimes the invoice takes much longer than you expected, and by the moment you get paid, you might not want that thing anymore or it’s already sold out. Then you have some extra money!

Tip 6 Pay yearly if possible

As a freelancer, monthly bills make me nervous. What if business hits a dry patch and these bills still need to be paid? So to give myself some breathing space, I like to pay for things yearly. Not only does this give me fewer monthly bills, it also usually gets me a full-year discount. So even though it might feel like a lot of money at once, I do save some in the end.

A good example is the Adobe Cloud subscription for designers. You probably already know that you will be using Photoshop and Illustrator for the next 12 months. And yes, that $700 bill looks pretty big, so you might settle on $50 monthly payments. But you know what? Pay the $700 right away and it’s out of your mind for a full year. Just make sure you note it in your calendar a year ahead, when you are up for a renewal.

Tip 7 My "Times-12" bank account

Sometimes yearly payments aren’t possible, so I thought of another solution: my "Times-12" bank account. Here I put all my monthly bills, times 12.

For example: I pay for a web-domain package $15 a month, so I put this amount times 12, which = $180 on this bank account. Now I know that I don’t have to worry about this bill until January next year. I try to do this with my internet and phone bill, business insurance, any bills for apps I use, etc. All the payments are direct-debits, so I don’t have to think about it at all. I have a simple excel sheet to keep track of the months that I have covered. So far right now, I’m all good through next year.

Tip 8 Use apps to help you track everything

If your bank already has a good mobile app, install it and make it a habit to log in daily. And if you’re not yet using some sort of accounting software, get one now. They’re different in each country because most of them only connect with certain local banks, and you want to make sure that they can connect with your bank so you can manage all your transactions within those apps.

The good thing is, these apps (Quickbooks, Moneybird, Mint) automatically import all your transactions and help you categorize them. Which means, at the end of the month you can see exactly how much money you spent on food, supplies or even how much coffee you had that month.

___

So these are just some handy tips for keeping track of your personal and business finances. But this is actually the easy part. In more articles to come, we will also tackle the more serious issues, the things we actually don’t really like to think about. For example: Should you get a professional accountant? What about insurance for when you get sick? What salary do I pay myself? Should you start a pension plan? And how to prepare an emergency account. Freelancing gives you a lot of freedom to be creative, but to be a happy freelancer, you also need to make sure you keep your finances fit and healthy.

Thanks for reading!

Cheers!

Rosa